In today’s fast-paced real estate market, savvy homebuyers and investors are always on the lookout for high-growth opportunities with long-term value. One such opportunity that continues to attract attention is the SkyTrain presale assignment in Coquitlam West and Surrey. These fast-growing communities, connected by efficient rapid transit, are becoming top choices for those seeking both convenience and strong condo investment potential.

In this post, we’ll explore why buying a presale assignment near a SkyTrain station—particularly in Coquitlam West and Surrey—can be one of the smartest moves you make this year.

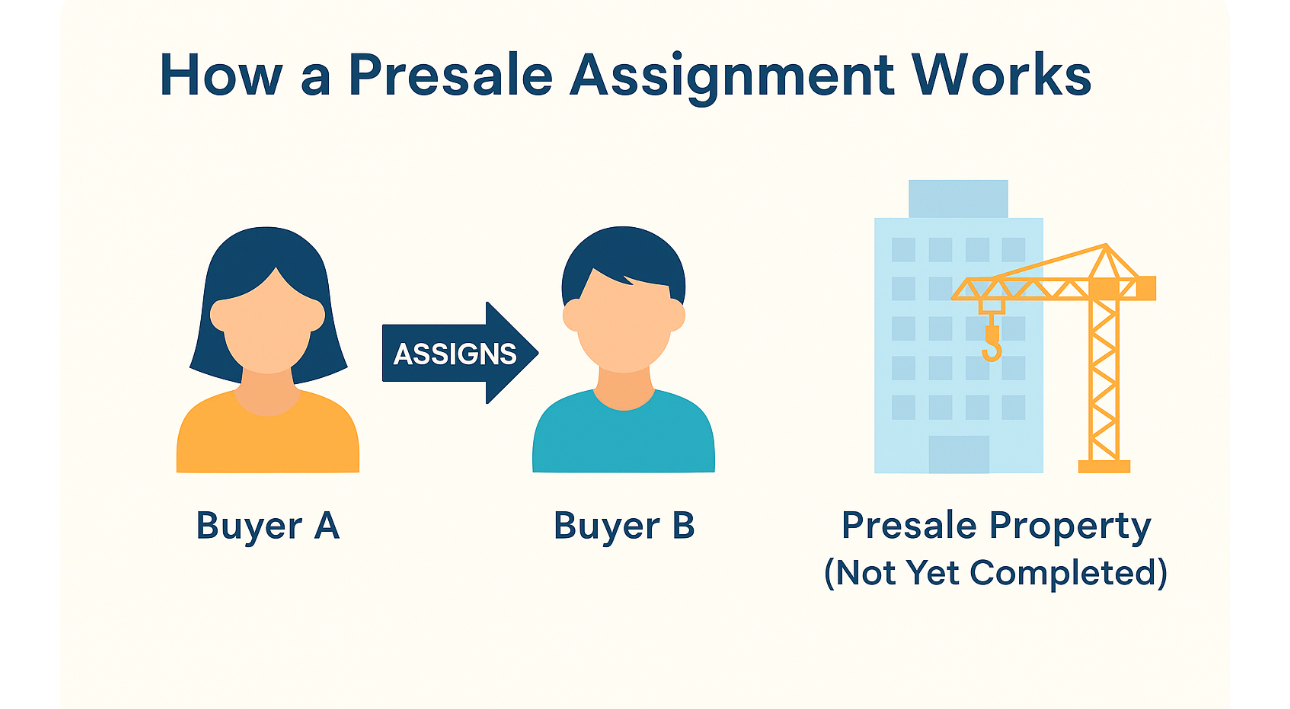

A presale assignment is when the original buyer of a presale condo (who purchased it directly from the developer) sells their contract to another buyer before the building is completed. The new buyer “assumes” the contract and becomes the new purchaser of the unit upon completion.

When these assignments are located near major transit lines—especially SkyTrain stations—they tap into the concept of Transit-Oriented Development (TOD).

TODs are real estate developments built around rapid transit hubs to promote walkability, reduce car dependence, and increase accessibility. These areas are in high demand, offering lifestyle convenience and future-proofed value.

Why SkyTrain Presale Assignments Are In Demand

2. Unmatched Convenience

Living near a SkyTrain station in Metro Vancouver means seamless access to the entire region. Whether commuting to work, school, or social events, residents enjoy shorter travel times and avoid the rising cost of car ownership.

2. Strong Rental and Resale Demand

Transit-accessible condos consistently command higher rental rates and experience lower vacancy. Investors love this kind of demand.

3. Access to Better Units in the Building

In most presale projects, the best-located units in the building are the first to sell.Rather than settling for what’s left, smart buyers are now choosing assignment units that offer better layout, better exposure, and long-term value. Most assignment sales offer units in prime building locations—while those sold last are often in inferior spot.

4. Buy Below Market Value

In many cases, assignment units are offered at pricing that was locked in 2 to 3 years earlier—often below current market values.ondos consistently command higher rental rates and experience lower vacancy. Investors love this kind of demand.

5.Future Growth and Community Development

Both Coquitlam West and Surrey are undergoing rapid urban transformation

6.Lower Upfront Cost and Flexible Timelines

This structure provides flexibility for investors to plan financing and time the market.

With their unbeatable location, rising demand, and promising return potential, SkyTrain presale assignments in Coquitlam West and Surrey stand out as one of the smartest condo investment choices in Metro Vancouver today.

Most importantly, assignment sales give you access to some of the best units in the building—locations that were snapped up early and may no longer be available directly from the developer.

Have questions about assignment sales or want to explore active listings near SkyTrain stations? I’d love to help!

NIDA BALATBAT Personal Real Estate Corp.

Call/Text: 778-859-7225

Email: Nida@LegendRealtor.com

Click the link in my bio to view current listings and book a free consultation.